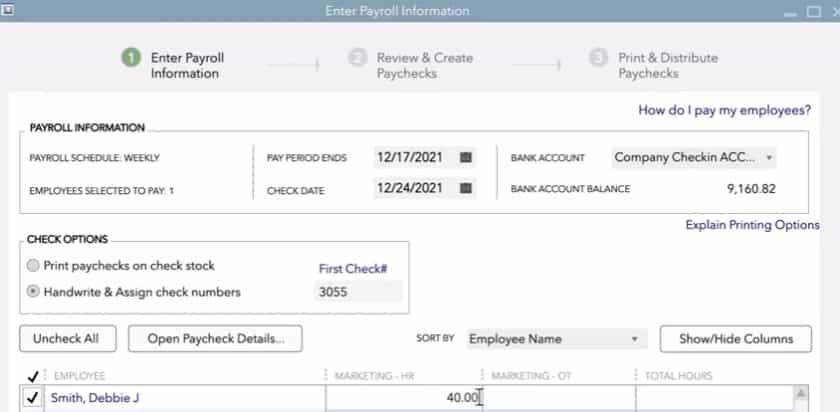

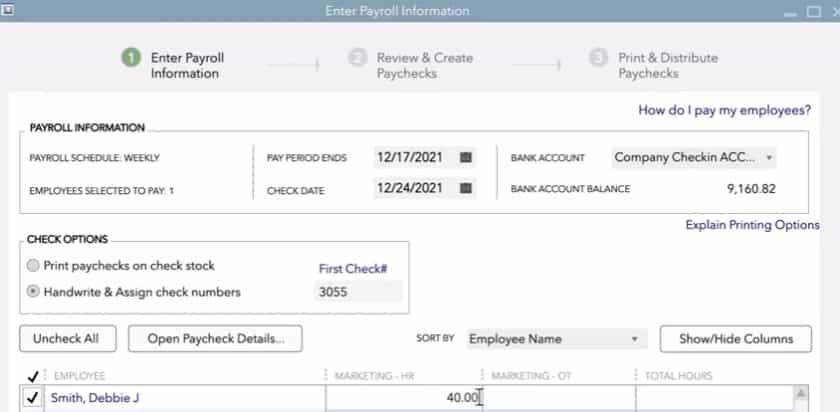

QuickBooks Desktop Assisted Full-Service. You can also pay tax deposits electronically with the Enhanced version. In addition, Enhanced Payroll can prepare and e-file federal and state tax forms. This version can create paychecks, calculate taxes and send direct deposits. This version of QuickBooks Payroll provides all the features the businesses may need to run payroll in-house. This is a great option for those companies/businesses that are willing to prepare and remit their own payroll tax forms. This QB Payroll version is best for businesses that simply need to create paychecks, send direct deposits, and calculate payroll taxes. The following outlines the features/benefits of each to help you choose the best option. There are three options of QuickBooks payroll from which you can choose.

QuickBooks Payroll will work with an existing QuickBooks version or it can be purchased as a stand-alone product.

#COMPARE QUICKBOOKS DESKTOP PAYROLL OPTIONS SOFTWARE#

QuickBooks accounting software is used by a large number of users, from consumers to bookkeepers and accountants, and the QuickBooks Payroll module lets you calculate payroll, pay employees, and file/prepare taxes.

The following will give you an overview of QuickBooks Payroll as a possible payroll option. Payroll is an essential part of any company and if you are searching for the best payroll option that will fit your needs, it can become confusing.

0 kommentar(er)

0 kommentar(er)